Introduction The 2026–27 Texas proposed biennial budget should be rejected this week when brought to the House floor on Thursday, April 10th. This budget, and many before it over the last two decades since Republicans gained a trifecta in 2003, appropriates too much...

BROWSE ALL POSTS IN:

Research

Texas Legislature on Track to Approve $48 Billion in New Spending

Texans to Receive Only $6 Billion in Property Tax Relief New Spending Reduces Potential Tax Cuts Now and in the Future When the Texas Senate meets this week to debate and adopt the 2026-27 budget for the state of Texas, it is likely to put Texas on track to approve...

Real Options for Eliminating Property Taxes in Texas

Property taxes are a financial burden that Texans can no longer afford to endure. Over the past 26 years, Figure 1 illustrates how property taxes have increased by an unsustainable 330%, far outpacing population and inflation growth of 136%. Figure 1. Growth in...

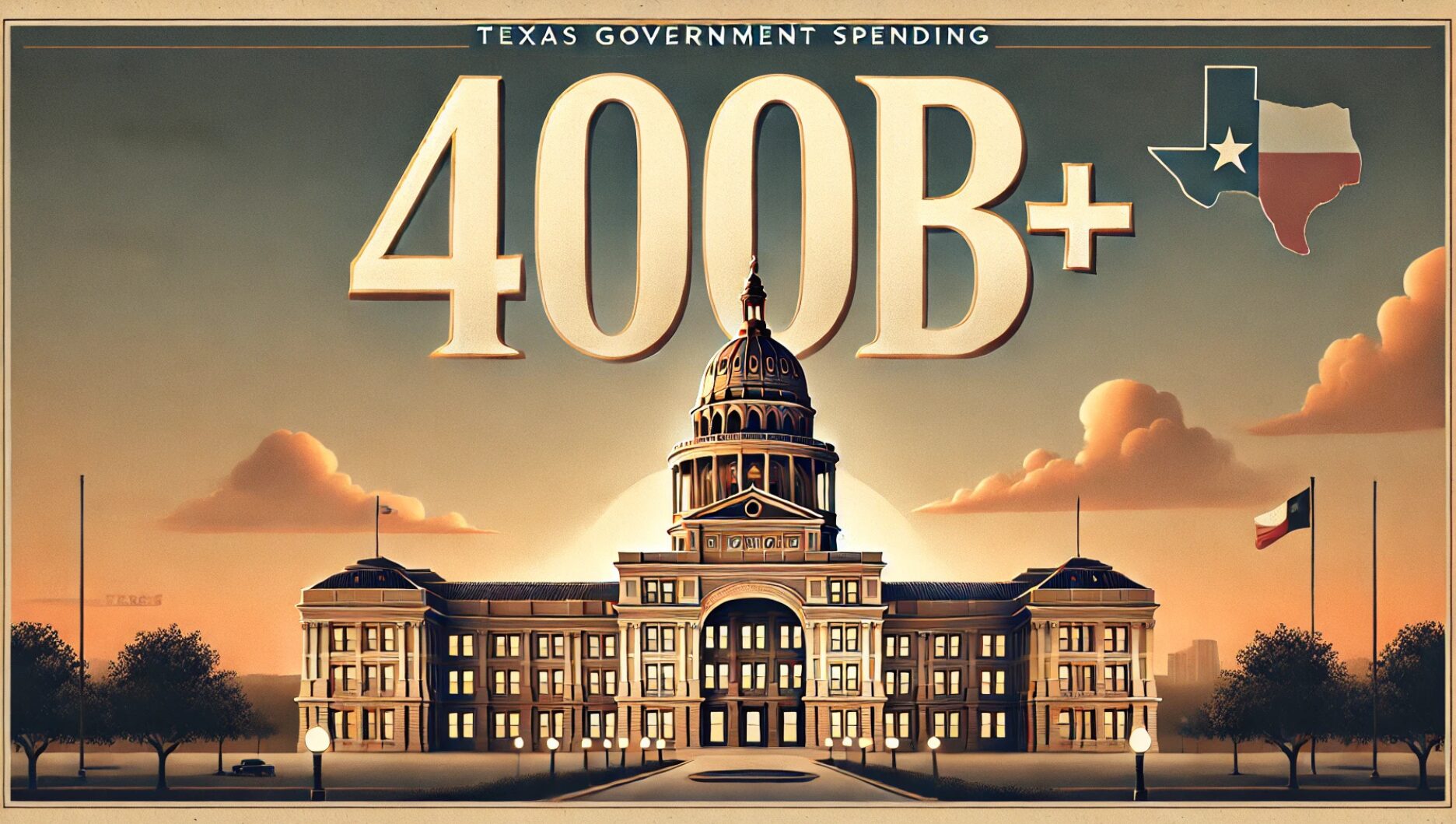

Texas Spending in the Current Biennium Likely to Top $400 Billion

The old truism is that there are two certainties in life, death and taxes. I’d like to modify that slightly to death and government spending. After all, government spending is why taxes exist. No spending, no taxes. But there is spending, and a lot of it. In...

2026-27 Frozen Texas Budget: Reining in Unsustainable Spending

Overview The 2024-25 Frozen Texas Budget would have kept the state’s budget from growing as it is already too big, thereby excessively burdening taxpayers. This also helps quickly achieve the three-step process to eliminate all property taxes over the next decade by...

The Real Size of Texas Government

Executive Summary The only thing the Texas Legislature must do when they meet every two years is adopt a budget. Not surprisingly, with years of practice they have gotten pretty good at spending taxpayers’ money. For instance, the Legislature appropriated $323.8...